Macroeconomics Midterm 2

Instructions

1.This is closed book, closed notes exam.

2.No calculators of any kind are allowed.

3. Show all the calculations .

4.If you need more space, use the back of the page.

5.Fully label all graphs .

Good Luck

1.(10 points). Suppose you deposit $x in a savings account

that pays interest of i%

per year. Write the equation that gives the amount of your savings after t years

2.(10 points). If a variable grows at constant rate, then

the natural log of the variable

is

a. Increasing function of time

b. Decreasing function of time

Linear function of time

Linear function of time

d. Quadratic function of time

e. Impossible to tell without more information

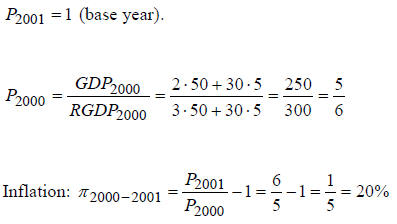

3.(15 points). The next table provides data on prices and

output in some artificial

economy for the years 2000 – 2002. The goods are labeled 1 and 2, so that

P1, P2,Q1,Q2 are prices and

quantities of the two goods respectively.

| Year | P1 | Q1 | P2 | Q2 |

| 2000 | 2 | 50 | 30 | 5 |

| 2001 | 3 | 57 | 30 | 19 |

Calculate the inflation rate between the years 2000 and

2001, using 2001 as the

base year.

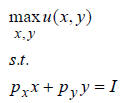

4.(30 points). Suppose that consumer's utility function is

u(x,y). The prices of

goods X and Y are PX,PY, and his income is I.

a. Write the consumer's problem.

b. Write the mathematical condition for optimality of

consumption bundle

and give a verbal interpretation of it.

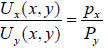

The condition for optimal consumption bundle:

Interpretation 1: The left hand side is the slope (in absolute value) of

the indifference

curve and the right hand side is the slope of the budget constraint. Thus, at

the optimum,

the indifference curve is tangent to the budget constraint.

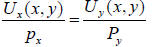

Interpretation 2: The above condition can be written as

The left hand side is the utility generated by extra

dollar spent on X and the right hand

side is the utility from extra dollar spent on Y. The optimal allocation of

income between

the two goods requires that those should be the same.

c. Suppose that the utility function is u(x,y)=x3y6.

Circle the correct

statement.

i. The consumer will spend 50% of his income on the good X

ii. The consumer will spend $3 on good X and $6 on good Y

The consumer will spend 1/3 of his income on

good X

The consumer will spend 1/3 of his income on

good X

iv. The consumer will spend all his income on good Y

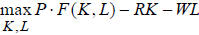

5.(20 points). Suppose that a firm has technology given by

Y=F(K,L), the price

of the final good (Y) is P, and the prices of inputs are R,W The firm is a price

taker in market for final good as well as the markets for inputs.

a. Write the firm's optimization problem.

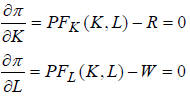

b. Derive the first order conditions for your problem in

a, and provide a

verbal interpretation of it.

Competitive (price taking firm) will hire inputs up to the point when their

marginal

product equals their prices.

| Prev | Next |